A Battery That Lasts 50% Longer Is Finally in Production

June 23, 2025

Excerpts from a story that appeared in the Wall Street Journal on June 20, 2025 written by Christopher Mims.

For the full story click here.

It’s an unlikely technology, developed in an unlikely place, at an unlikely time.

Ion Storage Systems’ novel solid-state batteries were inspired by hydrogen fuel-cell technology. The company’s high-energy-density batteries are now in production in a factory in Beltsville, Md. And though the U.S. is pulling back on investments in many energy technologies, a key backer is the Energy Department.

In other words, in an emerging battery category that could revolutionize electronics, Ion is one to watch.

Solid-state batteries—which trade the gooey center of conventional lithium-ion batteries for a solid core—have the potential to improve smartphones and EVs alike. Ion’s unusual approach could yield power cells that last 50% longer, charge significantly faster, and have a near-zero chance of catching fire when damaged.

Investors have been so disappointed that global venture-capital investment in such companies is on track to be at its lowest level since 2017, according to data from research firm PitchBook.

These are reasons to doubt Ion will succeed. Yet on a recent visit to the company’s pilot factory in Maryland, what I saw convinced me—as well as investors including Toyota Ventures and the Advanced Research Projects Agency-Energy—that the company has a chance. If Ion realizes its potential, it could allow the U.S. and its allies to leapfrog China’s battery giants in the race to electrify all our transportation and industrial systems.

“Here is a revolutionary technology, without the capital intensity of putting together a Gigafactory to make it work.”

Ion’s new chief executive, Jorge Schneider, former Vice President of Advanced Energy Storage Materials and Lithium Recycling at Albemarle Corporation.

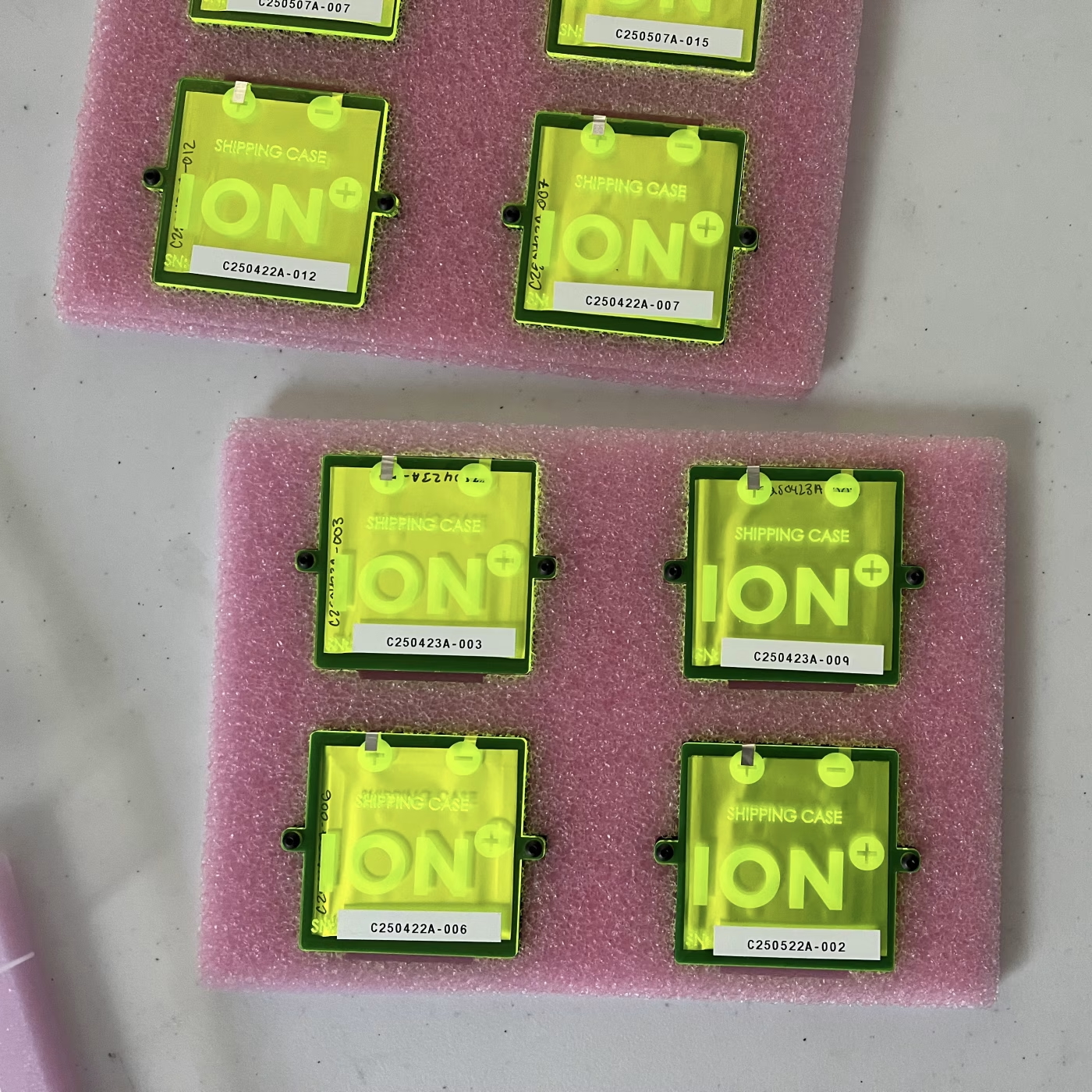

The company recently began shipping finished cells to potential customers, who are testing them. This includes the Department of Defense, which found in early trials that the cells held up, as well as electronics makers that aren’t ready to go on the record. The company earned an ARPA-E scale-up grant of $20 million because it showed momentum in making and shipping products, the initial necessary step in driving down costs.

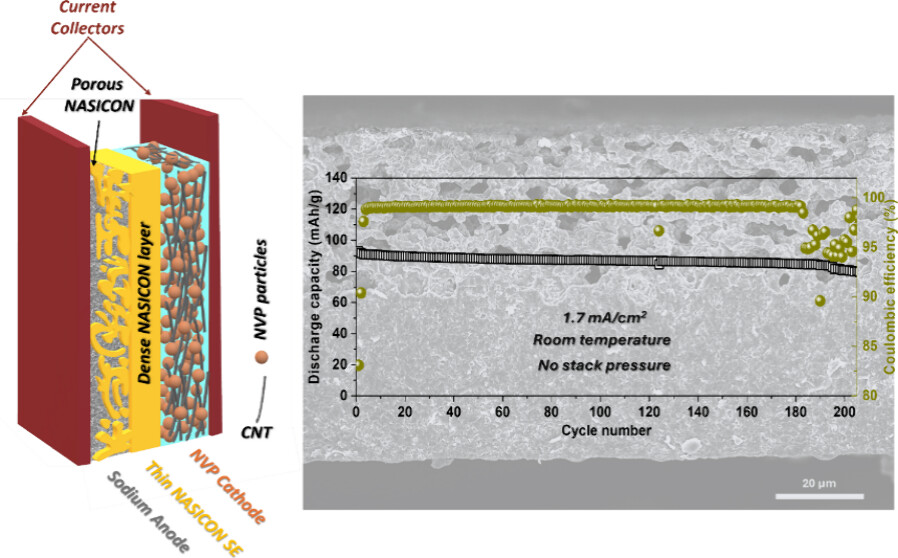

But here’s the problem: Standard solid-state batteries expand and contract as they charge and discharge, which can fracture the cell and render it useless.

In 2013, Eric Wachsman, a materials scientist at the University of Maryland, turned one of his Ph.D. students loose on the problem. Wachsman never cared much for batteries, having focused on their promising competitor, hydrogen fuel cells.

Together, he and his student, Greg Hitz, discovered the possibility of incorporating into lithium-ion batteries the same porous, rigid, ceramic substrates that are essential to making fuel cells.

Instead of the complicated layer-cake inside typical lithium-ion batteries (graphite, a liquid electrolyte, a plastic separator, more electrolyte, a layer of metal alloys) there are just three: lithium metal, this ceramic, and the usual metallic alloy.

Making the key ceramic layer of Ion’s batteries is tricky, requiring clean, controlled environments akin to chip factories. But once produced, the rest of the process is mostly the same as making normal batteries. This ease of manufacturing is what lured Ion’s new chief executive, Jorge Schneider, after stints at General Motors and a company that sells lithium to the battery industry.

This should allow Ion to partner with big battery makers and use their existing facilities. Hitz won’t say which, but giants like LG, Panasonic and Samsung would all be logical partners.

Ion’s current, small-scale manufacturing is the first step. It has to convince early-adopter customers that its near-term higher production costs are justified by the increased energy density of its cells—up to 50% better than the best conventional lithium-ion batteries.